Navigating Tariffs: Strategic Resilience from a Small Plastics Manufacturer

Small plastics supplier Team 1 Plastics shares strategic insights on navigating tariffs and staying resilient in a shifting automotive industry landscape.

Setting New Standards: Team 1 Plastics’ Latest Injection Molding Innovation

Discover Team 1 Plastics’ innovative new part, designed with precision and quality to meet the highest industry standards in injection molding.

Team 1 Plastics Guest Blogger – Mike Altenhof

Team 1 Plastics is pleased to periodically feature Guest Bloggers to share their perspectives of the plastics industry on Plastics Pipeline. We thank today’s Guest Blogger, Mike Altenhof of J&J Tool & Mold Ltd.

Electric Vehicle Takeover Does Not Have to Spell Disaster for Small Manufacturers

The increase of electric vehicles could spell disaster for some small manufacturers. Effective strategic planning is vital for success in a shifting market.

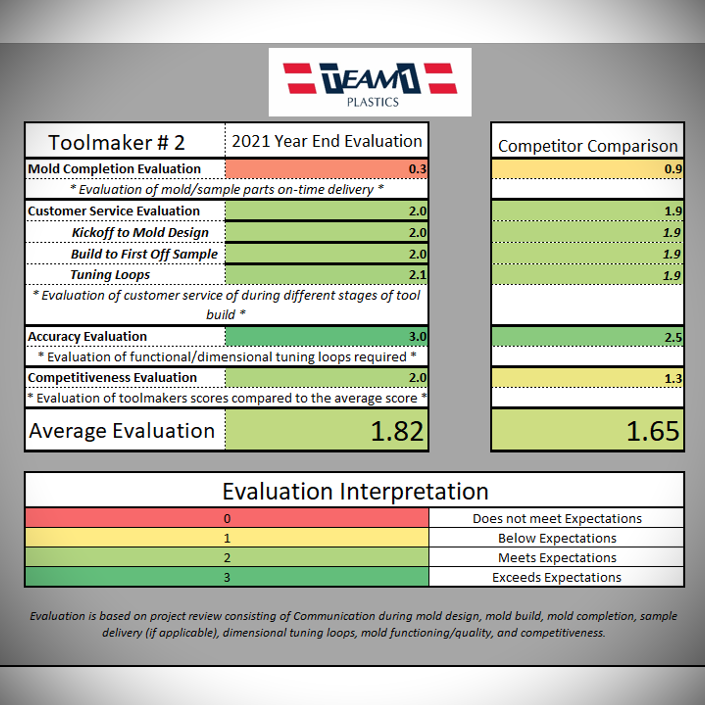

Unique & Effective Approach to Toolmaker Evaluations

For plastic injection molders, decision making for good business should not always be driven on cost alone. Could it be time to revise your toolmaker evaluation?

You Can Reduce Energy Costs

"You can lower your electric bill by thousands of dollars every month." Thousands of dollars each month? Is that really possible?